Demand Generation: The Revenue Operating System for B2B Growth

What You Need to Know

- Demand generation creates market awareness and buyer preference before prospects ever enter your sales funnel – it’s the foundation of predictable B2B revenue, not just another lead acquisition tactic

- Unlike traditional lead generation that gates content and prioritizes volume, modern demand generation builds authority through ungated educational content that establishes your brand as the category expert

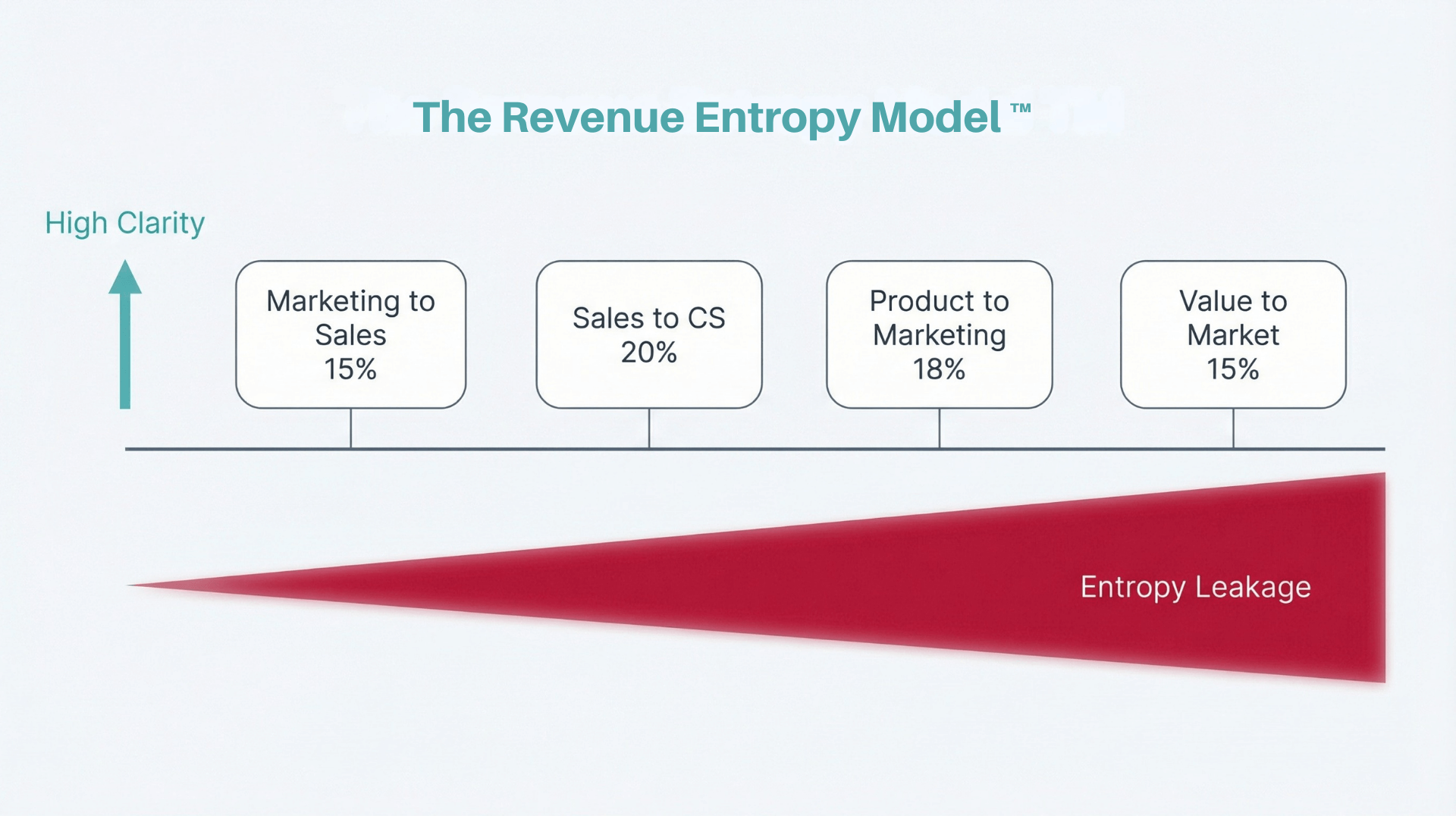

- The Revenue Entropy Model explains why 68% of B2B pipelines leak value: lack of clarity about your offering creates friction at every stage, from initial awareness through post-sale expansion

- Effective demand generation requires architectural thinking – coordinating content marketing, paid acquisition, sales enablement, and customer success into a unified system that compounds attention over time

- Measurement focuses on pipeline velocity and customer lifetime value rather than vanity metrics like MQLs or download counts that don’t predict revenue outcomes

- Building a demand generation engine takes 6-9 months to show meaningful results, but creates compounding returns that traditional lead generation can never match

Demand generation is the systematic process of creating awareness, preference, and buying intent for your product or service across your entire addressable market. Unlike lead generation, which focuses on capturing contact information from already-interested prospects, demand generation builds the conditions that make prospects interested in the first place. It’s the architecture that transforms anonymous market awareness into qualified pipeline, creating sustainable revenue growth rather than temporary spikes in form fills.

The distinction matters because B2B buying has fundamentally changed. Your prospects consume 7-13 pieces of content before ever speaking with sales. They compare 3-5 vendors in private Slack channels and peer networks before responding to outreach. Traditional lead generation tactics – gated whitepapers, aggressive SDR sequences, spray-and-pray advertising – create friction in a buying process that’s already happening with or without your participation.

Demand generation solves this by building what we call a Revenue Operating System: an integrated framework where content marketing establishes authority, paid acquisition amplifies reach, sales enablement converts interest into pipeline, and customer success drives expansion revenue. Each component feeds the others, creating compounding returns that isolated tactics cannot achieve.

“Volume won’t save you. Neither will budget. Architecture will.”

For B2B companies at Series A through Series C, this matters existentially. You’re competing against established players with larger budgets and stronger brand recognition. Your competitive advantage isn’t outspending them on ads or outmanning them with SDRs. Your advantage is building a more efficient system for converting market awareness into customer revenue – and that system is demand generation.

1. The Architecture of Modern Demand Generation

Unlike traditional lead generation, which treats marketing as a volume game focused on filling the top of funnel with as many contacts as possible, demand generation operates as a precision system designed for creating sustained buyer preference. The fundamental difference isn’t semantic – it’s architectural.

Lead generation optimizes for a single transaction: capturing contact information in exchange for gated content. Success metrics center on form completions, MQLs, and cost per lead. The assumption is that more leads automatically create more revenue, which breaks down immediately in B2B contexts where buying committees involve 6-10 stakeholders and sales cycles extend 3-9 months.

Demand generation optimizes for the entire buyer journey, from initial problem awareness through post-sale expansion. Success metrics focus on pipeline velocity, win rates, and customer lifetime value. The operating principle is that creating genuine expertise and authority attracts higher-quality buyers who close faster and spend more.

The Three-Layer Demand Architecture

Effective demand generation operates across three integrated layers, each serving distinct strategic functions while feeding into the unified goal of sustainable revenue growth.

Layer 1: Awareness Infrastructure builds your presence in the channels where your ideal customers already spend attention. This includes SEO-optimized educational content that ranks for high-intent searches, social media thought leadership that establishes individual expertise, and strategic partnerships that borrow authority from established brands. The goal is ensuring that when prospects begin researching solutions to problems you solve, your brand appears as a credible option worth considering.

Layer 2: Consideration Architecture nurtures prospects from awareness into active evaluation. This layer includes comparison content that positions your approach against alternatives, case studies that demonstrate results in contexts your prospects recognize, and product education that reduces perceived switching costs. The objective is compressing the consideration phase by providing all the information buying committees need to make confident decisions without requiring extensive sales engagement.

Layer 3: Conversion Systems transform interested prospects into qualified pipeline through strategic calls-to-action, demo experiences that showcase value immediately, and sales enablement content that equips your team to close deals efficiently. This layer connects marketing’s demand creation efforts to sales’ revenue generation mandate, ensuring that awareness and consideration translate into actual business outcomes.

[implementation_note]Start with Layer 1 even if you’re tempted to jump to conversion optimization. Without awareness infrastructure, you’re optimizing a pipeline that’s already leaking at the source. Build the foundation first, then layer in consideration and conversion capabilities.[/implementation_note]

Information Theory and Market Clarity

The reason demand generation outperforms lead generation in B2B contexts traces to information theory. In markets where buyers face high switching costs and long evaluation cycles, the quality of information they receive determines whether they enter your funnel at all.

Gated content creates information scarcity. It signals that your expertise has limited value unless prospects trade contact information for access. This works in consumer contexts where impulse purchases dominate, but fails in B2B where committees need to build consensus across multiple stakeholders before engaging vendors.

Ungated demand generation creates information abundance. It demonstrates expertise publicly, allowing prospects to self-educate at their own pace while naturally gravitating toward brands that provide the most valuable insights. This approach recognizes that in knowledge-intensive B2B markets, the company providing the best education usually wins the deal.

The Demand Generation Flywheel

Traditional lead generation operates linearly: spend budget, generate leads, pass to sales, close deals. Each cycle starts from zero, requiring constant new investment to maintain pipeline.

Demand generation operates as a flywheel where each successful customer increases the system’s momentum. High-quality content attracts prospects who become customers who provide case studies that attract better prospects who become higher-value customers who provide stronger social proof that attracts even better prospects.

This compounding effect explains why demand generation shows slower initial results but creates sustainable competitive advantages that lead generation cannot match. You’re building an asset that appreciates over time rather than renting attention that disappears the moment you stop paying for it.

2. Solving for Revenue Entropy™

Every B2B revenue engine faces a fundamental problem: value clarity degrades across every handoff in your go-to-market process. Marketing creates positioning that sales interprets differently. Sales makes promises that customer success struggles to deliver. Product builds features that marketing can’t explain clearly. This degradation – what we call Revenue Entropy™ – explains why 68% of B2B pipelines leak between stages.

The Revenue Entropy Model™ maps how clarity about your value proposition deteriorates as it passes through your organization and reaches prospects. High entropy means buyers struggle to understand what you do, why it matters, and how you differ from alternatives. This creates friction at every stage: longer sales cycles, lower win rates, higher churn, reduced expansion revenue.

Demand generation solves Revenue Entropy by creating a unified source of truth about your value proposition that remains consistent across all customer touchpoints. Instead of allowing each function to interpret your positioning independently, you build systematic content that everyone – from marketing to sales to customer success – references when explaining your offering.

Measuring Entropy in Your Funnel

Revenue Entropy manifests in observable metrics that most B2B companies track but few connect to their root cause. High entropy shows up as elongated sales cycles where prospects need multiple meetings to understand your value, elevated customer acquisition costs driven by inefficient conversion rates, and compressed lifetime values caused by buyers who never fully grasp your complete offering.

The diagnostic is straightforward. Record 10 sales calls where reps explain your product to new prospects. Transcribe the calls and count how many different ways your team describes what you do, why it matters, and who it’s for. If you see significant variation – different positioning, different value props, different competitive differentiators – you have high entropy.

Next, survey recent customers at 30 days post-purchase. Ask them to explain in their own words what problem your product solves and how it differs from alternatives they considered. If their explanations don’t match your positioning, you have entropy in the buyer’s understanding of your value.

Finally, measure pipeline velocity across stages. If prospects take unusually long to move from demo to evaluation or from evaluation to closed-won, entropy is creating decision friction. Buyers can’t commit to purchases they don’t fully understand.

Building the Anti-Entropy System

Demand generation reduces Revenue Entropy through systematic content creation that establishes and reinforces a consistent value narrative across every channel and touchpoint.

The Core Positioning Framework defines exactly what you do, who you serve, what outcomes you deliver, and how you differ from alternatives. This isn’t marketing copy – it’s operational documentation that every function references when creating customer-facing content. Marketing builds campaigns from it, sales references it in discovery calls, customer success uses it in onboarding, and product validates new features against it.

Content as Clarity Infrastructure translates your positioning framework into educational assets that reduce entropy at each funnel stage. Awareness-stage content establishes the problem you solve and why it matters now. Consideration-stage content demonstrates your unique approach and competitive advantages. Decision-stage content provides proof of outcomes in contexts your prospects recognize.

The key is ensuring this content maintains consistent messaging regardless of format or channel. Your SEO articles, sales decks, case studies, webinars, and product demos should tell the same story using the same language and the same value propositions. This consistency reduces entropy by ensuring that every interaction reinforces rather than contradicts the buyer’s understanding.

[common_mistake]Don’t confuse consistency with repetition. Anti-entropy content maintains the same core positioning while adapting depth and focus for different audiences and stages. A CFO evaluating your platform needs different details than an end-user, but both should hear the same fundamental value proposition.[/common_mistake]

Entropy Reduction Through Sales Enablement

The highest-leverage point for reducing Revenue Entropy is the sales process itself. Even perfect marketing content fails if sales teams interpret it differently or introduce competing narratives during deal cycles.

Sales enablement for demand generation means equipping reps with content that maintains message consistency while allowing personalization for specific buyer contexts. This includes discovery frameworks that guide conversations toward your differentiated strengths, competitive battle cards that position alternatives in ways that favor your approach, and objection-handling scripts that address concerns without contradicting your core positioning.

The goal isn’t making sales conversations robotic. It’s ensuring that regardless of which rep handles a deal, prospects hear the same essential story about what you do and why it matters. This reduces entropy by eliminating the variance that causes buyers to question their understanding or lose confidence in your expertise.

3. Building the Demand Capture Engine

Unlike spray-and-pray lead generation that treats all prospects as equally valuable and prioritizes volume over precision, effective demand generation requires surgical targeting focused on the accounts and personas that actually drive revenue growth. The distinction determines whether your marketing budget generates pipeline or just activity.

The foundation is your Ideal Customer Profile: the firmographic and behavioral characteristics that predict which accounts will close quickly, spend significantly, and expand reliably. This isn’t demographic guessing – it’s empirical analysis of your existing customer base to identify the patterns that separate high-value accounts from resource drains.

Building Your ICP from Data, Not Assumptions

Start by segmenting your customer base by lifetime value and time-to-first-value. The accounts that close quickly and generate outsized revenue are your signal. Analyze what they have in common: company size, industry, growth stage, technology stack, organizational structure, and buying behavior.

Next, reverse the analysis for your lowest-value customers. These accounts often take longer to close, spend less, churn faster, and generate disproportionate support costs. Identify their common characteristics so you can filter them out of targeting before wasting budget on prospects that won’t generate positive unit economics.

The result is an ICP that defines not just who can buy your product, but who should buy it based on empirical evidence of successful outcomes. This precision enables demand generation efficiency that volume-based lead generation cannot match.

Account-Based Demand Generation

With your ICP defined, demand generation shifts from broad market campaigns to targeted account strategies. account-based marketing coordinates marketing, sales, and customer success around specific high-value accounts, creating personalized experiences that accelerate pipeline velocity.

The demand generation approach to ABM differs from traditional account-based tactics in important ways. Rather than creating one-off campaigns for individual accounts, you build scalable systems that work across your entire target account list while allowing for account-specific personalization.

Programmatic ABM uses advertising platforms to deliver personalized content to decision-makers at target accounts across channels. LinkedIn, programmatic display, and intent data providers enable you to reach the right people at the right companies with messaging tailored to their specific challenges and buying stage.

Content Personalization adapts your demand generation content for different account segments. A Series A startup evaluating your platform has different concerns than a Series C company, even if both fit your ICP. Personalized landing pages, dynamic case studies, and segment-specific webinars address these differences without requiring completely custom content for each account.

Sales and Marketing Orchestration ensures that marketing’s demand generation efforts and sales’ account-penetration tactics reinforce rather than contradict each other. When marketing runs campaigns targeting specific accounts, sales receives alerts so they can coordinate outreach. When sales schedules meetings with target accounts, marketing pauses advertising to avoid message saturation.

[pro_tip]Start with a target account list of 100-300 companies. Smaller lists lack statistical power for optimization. Larger lists dilute focus and budget, reducing impact per account. The sweet spot allows concentrated investment while maintaining enough volume to identify what’s working.[/pro_tip]

Intent Signal Integration

Modern B2B buyers signal buying intent long before they contact vendors. They research problems on Google, read competitor content, attend industry webinars, and discuss solutions in peer networks. Intent data captures these signals, allowing demand generation to prioritize accounts actively evaluating solutions you provide.

Intent data comes from three sources. First-party intent tracks behavior on your own properties: which pages prospects visit, what content they download, how they engage with your emails. Second-party intent captures engagement with partner content: co-marketing webinars, integration marketplace activity, and reseller interactions. Third-party intent monitors behavior across the broader web: searches for relevant keywords, consumption of competitor content, and participation in industry forums.

Effective demand generation combines these signals to identify accounts transitioning from passive awareness to active evaluation. When intent spikes for accounts in your ICP, you increase investment in targeted advertising, prioritize sales outreach, and trigger account-specific nurture campaigns. This precision ensures budget flows toward prospects most likely to convert rather than being evenly distributed across accounts in different buying stages.

Channel Strategy for Demand Capture

Demand generation requires multi-channel orchestration because B2B buyers encounter your brand across diverse touchpoints before making purchase decisions. The goal isn’t omnipresence – it’s strategic presence in the specific channels where your ICP actually spends attention.

Organic search captures high-intent prospects actively researching solutions. Content & SEO strategies target keywords that indicate purchase intent, creating landing pages optimized for both search engines and conversion. The advantage is persistent visibility without ongoing advertising spend, though results take 6-9 months to materialize.

Paid advertising amplifies reach to target accounts through LinkedIn, programmatic display, and search engine marketing. The advantage is immediate visibility and precise targeting capabilities, though it requires continuous investment and sophisticated management to maintain positive ROI.

Social selling builds relationships with decision-makers through thoughtful engagement on LinkedIn and industry communities. Sales teams and executives use social platforms to share insights, participate in discussions, and build credibility with target accounts before formal outreach.

Events and webinars create high-engagement touchpoints that accelerate deal cycles. Industry conferences provide face-to-face interactions with prospects, while webinars scale educational content to hundreds of accounts simultaneously.

The key is choosing channels based on where your ICP actually discovers and evaluates solutions, not where you prefer to operate or what competitors are doing. A developer tool company may generate more pipeline from GitHub engagement and technical blog content than from LinkedIn ads, while an enterprise sales platform might see the reverse.

4. Content as a Relational Asset

Unlike traditional content marketing that treats every piece as an isolated lead generation tool optimized for form fills and MQL creation, demand generation views content as relational infrastructure that builds cumulative authority over time. The distinction shapes what content you create, how you distribute it, and how you measure success.

Transactional content marketing gates valuable insights behind forms, prioritizing short-term lead capture over long-term authority building. Each piece exists to generate immediate conversions, measured by downloads and form completions. The strategy implicitly assumes prospects will trade contact information for content before understanding whether your expertise is credible.

Relational content marketing creates ungated educational resources that demonstrate expertise publicly, allowing prospects to self-educate while naturally gravitating toward your brand. Measurement focuses on engagement depth, return visits, and pipeline influence rather than form completions. The strategy recognizes that in B2B markets where buying cycles span months and involve multiple stakeholders, the company providing the best education usually wins the deal.

The Content Authority Stack

Effective demand generation requires a layered content strategy where each tier serves distinct purposes while feeding into the unified goal of establishing your brand as the definitive category expert.

Foundation Layer: SEO-Optimized Guides capture high-intent search traffic for keywords that indicate active problem-solving. These comprehensive resources (2,000-3,000 words) rank for terms like “how to build demand generation strategy” or “B2B marketing attribution models,” attracting prospects at the beginning of their buyer journey. The goal is becoming the default educational resource that prospects encounter when first researching solutions to problems you solve.

Middle Layer: Frameworks and Methodologies introduce proprietary approaches that differentiate your thinking from competitors. These pieces (1,500-2,500 words) establish your unique perspective on industry challenges, creating mental models that favor your solution architecture. Examples include “The Revenue Entropy Model” or “Funnel Velocity Framework” – concepts that prospects internalize and reference when evaluating alternatives.

Top Layer: Data-Driven Research publishes original insights that can’t be found elsewhere, positioning your brand as a data authority. This includes industry benchmarks, original survey research, and analysis of trends that competitors haven’t identified yet. The advantage is earned media coverage and backlinks from industry publications, amplifying reach beyond your owned channels.

[key_takeaway]The authority stack works because each layer reinforces the others. SEO guides attract prospects, frameworks shape how they think about solutions, and research establishes your credibility as an industry thought leader. Together they create compounding authority that isolated content pieces cannot achieve.[/key_takeaway]

Content Distribution Architecture

Creating valuable content matters less than ensuring it reaches prospects when they’re actively seeking solutions. Distribution determines whether your content generates demand or sits unread in your blog archive.

Owned Distribution includes your blog, email list, and social media channels. These provide reliable reach to existing audiences but limited ability to attract new prospects. The key is optimizing owned channels for depth over breadth: focus on delivering exceptional value to subscribers rather than maximizing follower counts.

Earned Distribution happens when industry publications, influencers, and customers share your content organically. This requires creating insights genuinely worth sharing: original data, contrarian perspectives, or frameworks that solve widespread problems. Earned distribution amplifies reach exponentially but can’t be manufactured through promotion alone.

Paid Distribution uses advertising to amplify high-performing content to target audiences. Unlike traditional advertising that promotes products, content amplification markets your expertise to prospects who aren’t yet ready to evaluate vendors. This builds brand awareness and authority before prospects enter active buying cycles.

The most effective demand generation programs combine all three distribution types in coordinated campaigns. You publish original research on your blog (owned), earn coverage in industry publications (earned), and amplify reach through targeted LinkedIn promotion (paid). Each channel reinforces the others, creating compound visibility that organic-only strategies cannot match.

Measuring Content’s Revenue Impact

Traditional content marketing measures success through vanity metrics that don’t predict revenue: page views, time on site, and social shares. Demand generation requires connecting content performance to actual business outcomes.

Pipeline Influence tracks which content assets prospects engage with before entering your sales funnel. Marketing automation platforms attribute conversions to specific pieces, revealing which content drives qualified pipeline versus traffic that doesn’t convert.

Deal Velocity measures whether prospects who engage with your content close faster than those who don’t. If comprehensive guides or framework content correlate with shortened sales cycles, you have evidence that content is reducing friction in the buying process.

Win Rate Correlation identifies whether content engagement predicts deal outcomes. If prospects who consume multiple pieces of thought leadership content convert at higher rates, you’re demonstrating the relationship between education and purchase confidence.

Customer Lifetime Value determines whether content-influenced customers spend more and churn less than customers acquired through other channels. If content-educated buyers show higher retention and expansion rates, you’re proving long-term value beyond initial acquisition costs.

These metrics require sophisticated attribution modeling and often take 6-12 months to show statistical significance. The complexity explains why most companies default to measuring downloads and form fills – but those vanity metrics don’t prove ROI to CFOs who control marketing budgets.

5. Measuring What Actually Matters

Demand generation succeeds or fails based on its ability to generate predictable revenue growth, not its ability to produce marketing activity. Yet most B2B companies measure the wrong metrics, optimizing for vanity statistics that don’t predict business outcomes.

The fundamental problem is that traditional marketing metrics were designed for lead generation, not demand generation. MQLs, form completions, and cost per lead made sense when marketing’s job was filling the top of funnel with as many contacts as possible. They fail completely when marketing’s job is creating sustained buyer preference across extended evaluation cycles.

The Demand Generation Metrics Framework

Effective measurement requires tracking leading indicators that predict pipeline quality and lagging indicators that prove revenue impact. Together they provide the data needed to optimize investment across channels and campaigns.

Pipeline Velocity measures how quickly deals move through your sales process from initial engagement to closed-won. The formula is: (Number of Opportunities × Average Deal Value × Win Rate) / Sales Cycle Length. Higher velocity means your demand generation is attracting better-qualified prospects who close faster and require less sales effort.

Track velocity by cohort to identify which marketing channels and campaigns generate the fastest-moving pipeline. If content-influenced deals move 40% faster than paid-ad-sourced deals, reallocate budget accordingly.

Marketing Sourced Pipeline quantifies the dollar value of opportunities where marketing touchpoints played a role in initial engagement. This differs from Marketing Qualified Leads because it measures pipeline created rather than contacts captured. Focus on first-touch and multi-touch attribution to understand how awareness-stage demand generation influences deal creation.

Customer Acquisition Cost calculates the total cost of acquiring new customers, including marketing spend, sales salaries, and technology costs, divided by number of customers acquired. Effective demand generation reduces CAC over time by building compounding awareness that makes acquisition more efficient.

Compare CAC by acquisition channel to identify which demand generation investments deliver profitable unit economics. If SEO-driven customers cost $4,000 to acquire while paid-ad customers cost $12,000, the strategic imperative becomes clear even if paid ads generate more immediate volume.

[real_world_example]A Series B SaaS company tracked CAC by channel and discovered their content marketing program generated customers at $3,200 CAC versus $9,800 for paid acquisition. They shifted 60% of their budget to content, accepting slower short-term growth for dramatically better long-term economics. After 18 months, their blended CAC dropped from $8,500 to $4,900 while monthly pipeline grew 240%.[/real_world_example]

Pipeline Coverage Ratio divides your total pipeline value by your revenue target. A healthy ratio is 3-4x, meaning you maintain $3-4 in pipeline for every $1 in revenue target. Lower ratios indicate demand generation isn’t creating sufficient pipeline volume, while significantly higher ratios suggest qualification problems.

Leading Indicators for Early Course Correction

Lagging indicators like revenue and customer acquisition prove demand generation’s impact but arrive too late for tactical adjustments. Leading indicators provide early signals about whether your programs will hit targets.

Content Engagement Depth tracks how prospects interact with your educational content. Measure not just page views but time on page, pages per session, and return visitor rates. Deep engagement indicates you’re building the authority and trust that precedes purchase intent.

Set benchmarks based on your own historical data. If prospects who eventually close typically consume 5+ pieces of content averaging 4+ minutes per piece, you can identify high-intent accounts early based on engagement patterns.

Intent Signal Strength monitors third-party data showing which accounts are actively researching solutions you provide. Rising intent among accounts in your ICP predicts pipeline creation 30-60 days before prospects take action. This early warning enables proactive outreach when buyers are most receptive.

Share of Voice measures your visibility relative to competitors across organic search, social media, and industry publications. Increasing share of voice predicts growing brand awareness that will convert to pipeline over subsequent months. Declining share indicates competitors are out-executing you on demand generation, requiring strategic response.

Qualified Traffic Growth tracks visitors who match your ICP characteristics. Overall traffic increases matter less than targeted traffic growth from the accounts and job titles you actually want to reach. Use reverse IP lookup and firmographic data to segment analytics by prospect quality.

The Attribution Reality Check

Attribution modeling attempts to assign credit for conversions to specific marketing touchpoints, answering the question “which channels drive revenue?” The reality is more complex than most attribution models acknowledge.

B2B buyers interact with 20+ touchpoints across 6-9 months before making purchase decisions. They encounter your brand through organic search, paid ads, social media, webinars, sales outreach, and peer recommendations. Isolating any single touchpoint as “the” driver misrepresents the compounding nature of demand generation.

The solution isn’t more sophisticated attribution models – it’s accepting that demand generation works through accumulation rather than attribution. Your job is ensuring prospects encounter consistent, valuable content across every channel they use to research solutions. Measurement focuses on whether the entire system generates profitable growth, not which individual touchpoint deserves the most credit.

6. Building Your Demand Generation Framework

Moving from demand generation theory to operational execution requires a systematic framework that coordinates people, processes, and technology into a unified revenue engine. Most B2B companies fail not because they misunderstand demand generation principles, but because they can’t translate those principles into daily workflows that produce consistent results.

The 90-Day Foundation Build

Effective demand generation requires 6-9 months to show meaningful results, but you can establish the operational foundation in 90 days. This initial build phase focuses on creating the minimum viable infrastructure needed to generate and measure demand systematically.

Days 1-30: Audience and Positioning Clarity begins with empirical ICP analysis, surveying your best customers to identify the problems they were trying to solve, the alternatives they considered, and why they chose your solution. This research produces the positioning framework that will guide all subsequent content and messaging decisions.

Simultaneously, map your buyer’s journey from initial problem awareness through purchase decision and post-sale expansion. Identify which channels prospects use at each stage, what information they need to progress, and where current buyers report experiencing the most friction. This journey map reveals the specific content and experiences your demand generation engine needs to produce.

Days 31-60: Content Infrastructure translates your positioning framework and buyer journey map into an editorial calendar focused on creating the foundation layer of your content authority stack. Prioritize comprehensive SEO guides for high-intent keywords where prospects begin researching solutions to problems you solve.

Launch with 5-7 cornerstone articles (2,000-3,000 words each) that target different aspects of the problem you solve. These pieces need to rank in organic search, so prioritize keyword research and technical SEO. Publish one per week to build momentum while maintaining quality.

Simultaneously, establish your marketing automation infrastructure for capturing and nurturing prospects who engage with content. Connect your website analytics to your CRM so you can track which content influences pipeline creation.

Days 61-90: Distribution and Measurement activates paid distribution channels to amplify your content to target accounts. Start with a modest budget ($5,000-10,000 monthly) testing LinkedIn and programmatic display advertising promoting your best-performing content to accounts matching your ICP.

Establish baseline metrics for the demand generation framework you’ve built: traffic from target accounts, content engagement depth, pipeline influenced by marketing, and time from first touch to opportunity creation. These benchmarks enable you to measure improvement as you optimize the system.

The Content Multiplication System

Creating original content for every channel and format is unsustainable. Effective demand generation multiplies the impact of core assets by systematically adapting them for different channels and audiences.

Start with comprehensive cornerstone content (2,500-3,500 words) that establishes your expertise on a specific topic. This becomes the canonical resource you’ll reference and build upon in all derivative content.

Format Adaptation transforms written content into other media. Record yourself presenting the key concepts as a webinar or video tutorial. Extract key points into a slide deck for sales enablement. Turn the framework into an infographic that visualizes complex concepts. Each adaptation reaches different audience segments while reinforcing the same core messages.

Depth Variation creates content at different depth levels for various audience sophistication. The comprehensive guide serves prospects deep in research. A 500-word summary version serves prospects just beginning to explore the problem. A 10-minute video walkthrough serves prospects who prefer visual learning over reading.

Channel Optimization adapts core content for platform-specific distribution. LinkedIn posts highlight contrarian insights that spark discussion. Twitter threads break down complex frameworks into digestible takeaways. Email newsletters provide curated synthesis connecting multiple pieces of related content.

The multiplication system ensures you maintain consistent messaging across all channels while producing the volume of content needed to maintain visibility throughout extended B2B buying cycles.

[implementation_note]Assign one team member to own the multiplication process. Without dedicated ownership, teams default to creating net-new content instead of maximizing existing assets. This person should have authority to coordinate across marketing, sales, and customer success to extract insights and examples that make derivative content more valuable than the original.[/implementation_note]

Technology Stack for Scale

Demand generation requires coordinating multiple systems that each serve specific functions in the overall framework. The goal is integration that enables automation without creating rigid processes that prevent adaptation.

Marketing Automation Platform serves as the central nervous system connecting website behavior, email engagement, and advertising performance. HubSpot, Marketo, and Pardot are the enterprise standards, with pricing typically starting at $800-2,000 monthly for professional tiers that include the automation and reporting capabilities demand generation requires.

Customer Relationship Management tracks all prospect and customer interactions, maintaining the single source of truth about account status and sales engagement. Salesforce dominates enterprise B2B, though Pipedrive and HubSpot CRM serve mid-market companies effectively at lower price points.

Content Management System hosts your website and blog, providing the technical foundation for SEO and content distribution. WordPress dominates B2B content marketing for good reason: it’s flexible, well-supported, and integrates with virtually every marketing technology platform.

Analytics and Attribution connects marketing activities to revenue outcomes, answering which channels and campaigns drive profitable growth. Google Analytics provides free baseline capability, while specialized attribution platforms like Bizible (now Marketo Measure) and DreamData offer sophisticated multi-touch attribution for companies willing to invest $2,000-5,000 monthly.

Intent Data Providers identify accounts actively researching solutions you provide, enabling proactive outreach to prospects showing buying signals. Bombora, 6sense, and G2 Buyer Intent offer different approaches to capturing and scoring intent signals, with costs varying based on your total addressable market size.

The key is starting with minimum viable technology and adding sophistication as you prove ROI. A Series A startup can execute effective demand generation with HubSpot Marketing Hub and Salesforce. Enterprise companies require more complex stacks, but the core principles remain identical.

7. Common Pitfalls and How to Avoid Them

Unlike demand generation done correctly – which builds compounding authority that reduces customer acquisition costs while increasing deal velocity – most B2B companies sabotage their own efforts through predictable mistakes that undermine long-term effectiveness for short-term activity.

The Impatience Trap

Demand generation requires 6-9 months to show meaningful pipeline results because you’re building market awareness and authority that didn’t previously exist. Most companies abandon the strategy after 60-90 days when they don’t see immediate lead flow, reverting to paid acquisition tactics that generate faster results but worse unit economics.

The problem is confusing activity with progress. Lead generation creates immediate activity: form fills, MQLs, and pipeline that marketing can report to executives. Demand generation creates delayed progress: rising organic traffic, increasing brand awareness, and improving win rates that take quarters to materialize statistically.

Companies that succeed with demand generation commit to 12-month minimum execution windows, measuring success through leading indicators (content engagement, brand search growth) rather than immediate pipeline. They accept that months 1-6 will show limited results while the foundation is being built, then scale investment aggressively once early signals indicate the system is working.

Gating Content That Should Be Free

The fastest way to undermine demand generation is requiring form fills to access valuable content. Gating signals that your expertise has limited value unless prospects trade contact information for access. This works in consumer contexts where impulse purchases dominate, but fails in B2B where committees need to build consensus across multiple stakeholders before engaging vendors.

The argument for gating content is understandable: ungated content doesn’t generate leads for sales to pursue. But this perspective misses how B2B buying actually works. Your prospects will consume 7-13 pieces of content before contacting sales regardless of whether you gate it. The question is whether they consume your content or your competitors’.

Ungated content builds authority and trust that manifests in higher win rates and faster deal cycles. Prospects who self-educate through your content enter sales conversations already convinced of your expertise and alignment with their needs. This more than compensates for the lack of early-stage lead capture.

The exception is truly premium content that provides exceptional value: original research with proprietary data, comprehensive implementation guides with templates, or interactive tools that solve specific problems. Gating this content is appropriate because prospects recognize they’re receiving something worth trading information for.

[common_mistake]Don’t gate every piece of content out of habit or because your marketing automation platform makes it easy. Reserve gating for the 10-20% of content that truly justifies the friction you’re adding to the buyer’s journey.[/common_mistake]

Measuring the Wrong Metrics

Most companies optimize demand generation for metrics that don’t predict revenue: website traffic, social media followers, and content downloads. These vanity metrics create the illusion of progress while masking failure to generate pipeline and customers.

The solution is ruthless focus on metrics that connect marketing activity to business outcomes: pipeline generated, deal velocity, win rates, and customer acquisition cost. If increasing blog traffic doesn’t lead to increasing pipeline within 90 days, traffic growth is irrelevant. If social media engagement doesn’t correlate with win rates, follower counts don’t matter.

This requires sophisticated analytics infrastructure that most startups lack initially. Start with simple proxy metrics that indicate demand generation is working: returning visitor rates (shows you’re building audience loyalty), time on site (indicates engagement depth), and branded search volume (proves awareness is growing). These leading indicators predict pipeline growth before it materializes in lagging revenue metrics.

Lack of Sales Alignment

Demand generation fails when marketing creates awareness and sales pursues unrelated tactics that ignore or contradict marketing’s positioning. The most common manifestation is marketing investing in educational content while sales pushes aggressive outbound sequences that treat prospects like leads to be closed rather than buyers to be educated.

The alignment requirement goes deeper than weekly sync meetings. Effective demand generation requires sales to become extensions of the educational mission marketing is pursuing. This means sales reps need to reference marketing content in discovery calls, use customer success stories marketing has developed, and reinforce positioning frameworks marketing has established.

Building this alignment requires changing how sales is measured and compensated. If reps are evaluated primarily on short-term activity metrics (calls made, emails sent), they’ll optimize for volume over quality and ignore demand generation content that serves long-term relationship building. If reps are measured on deal quality and customer lifetime value, they’ll naturally align with demand generation principles that prioritize ideal customers over any customers.

FAQ: Demand Generation in Practice

What is the meaning of demand generation?

Demand generation is the systematic process of creating market awareness and buyer preference for your products or services before prospects enter your sales funnel. Unlike lead generation, which focuses on capturing contact information from already-interested buyers, demand generation builds the conditions that make buyers interested in the first place through educational content, thought leadership, and brand authority.

What does a demand generation person or manager do?

A demand generation manager orchestrates the entire system that creates awareness, nurtures consideration, and generates qualified pipeline. This includes developing content strategy, managing multi-channel campaigns, coordinating sales and marketing alignment, and measuring how marketing activities influence revenue. The role requires equal parts strategic thinking, analytical rigor, and cross-functional coordination. Unlike traditional marketing managers who focus on lead volume, demand generation managers optimize for pipeline quality and customer lifetime value.

What is the difference between demand generation and lead generation?

Lead generation optimizes for capturing contact information in exchange for gated content, measuring success through form completions and MQLs. Demand generation optimizes for building sustained buyer preference through ungated education, measuring success through pipeline velocity and win rates. Lead generation treats marketing as a transaction – trade content for contact info. Demand generation treats marketing as relationship building – demonstrate expertise to earn trust. Lead generation works for impulse purchases; demand generation works for complex B2B sales involving multiple stakeholders and extended evaluation cycles.

What is B2B demand generation?

B2B demand generation applies demand generation principles to business-to-business contexts where buying cycles span 3-9 months and involve 6-10 stakeholders per decision. This requires coordinating multiple touchpoints across extended timelines, creating content that serves different committee members with different priorities, and measuring success through metrics that account for long sales cycles. B2B demand generation emphasizes ungated content, thought leadership, and educational marketing over aggressive lead capture tactics that create friction in complex buying processes.

Why is demand generation important for B2B companies?

B2B buyers now consume 7-13 pieces of content before engaging with sales, making demand generation the only way to influence purchase decisions during the research phase. Companies that invest in demand generation attract better-qualified prospects who close faster and spend more because they’ve self-educated through your content. This creates sustainable competitive advantages that paid acquisition can’t match: compounding organic visibility, reduced customer acquisition costs, and higher win rates. For startups competing against established brands, demand generation offers the most efficient path to building market presence without matching incumbents’ advertising budgets.

How do you measure demand generation success?

Measure demand generation through metrics that connect marketing to revenue: pipeline velocity (how quickly deals move through sales stages), marketing-sourced pipeline value (total opportunity value influenced by marketing touchpoints), customer acquisition cost (total cost of acquiring customers including marketing and sales), and win rate by source (conversion rates for opportunities from different channels). Leading indicators include content engagement depth, branded search volume growth, and intent signal strength from target accounts. Avoid vanity metrics like website traffic and social followers unless they correlate with pipeline and revenue outcomes.

Essential Points to Remember

Demand generation creates sustained buyer preference through systematic education and authority building rather than transactional lead capture. This distinction determines whether your marketing budget generates compounding returns or temporary spikes in activity that disappear when you stop spending.

The Revenue Entropy Model explains why most B2B funnels leak value: lack of clarity about your offering creates friction at every stage from awareness through expansion. Demand generation solves this by establishing consistent positioning across all touchpoints, reducing the information degradation that causes extended sales cycles and low win rates.

Unlike lead generation tactics that prioritize volume over quality, effective demand generation requires surgical precision targeting accounts that match your Ideal Customer Profile. This means analyzing existing customers to identify patterns that predict successful outcomes, then building campaigns that reach only prospects likely to close quickly and spend significantly.

Content serves as relational infrastructure rather than lead generation bait. Ungated educational resources demonstrate expertise publicly, allowing prospects to self-educate while naturally gravitating toward brands that provide the most valuable insights. This approach recognizes that in B2B markets, the company providing the best education usually wins the deal.

Measurement focuses on pipeline velocity, customer acquisition cost, and win rates rather than vanity metrics like form completions and MQLs that don’t predict revenue outcomes. This requires sophisticated attribution modeling and often takes 6-12 months to show statistical significance, which explains why most companies revert to easier-to-measure lead generation tactics.

Building an effective demand generation engine takes 90 days to establish operational foundation and 6-9 months to show meaningful pipeline results. Companies that succeed commit to minimum 12-month execution windows, measuring progress through leading indicators like content engagement and branded search growth rather than demanding immediate results.

The most common failure modes are impatience that causes abandonment before the system matures, gating content that should remain free to build authority, measuring the wrong metrics that don’t predict revenue, and lack of sales alignment that causes marketing and sales to pursue contradictory strategies.

For B2B startups competing against established brands, demand generation offers the most efficient path to building market presence. While incumbents can outspend you on paid acquisition, they can’t outteach you if you’re willing to invest in systematic content creation and distribution. The compound returns from organic visibility and brand authority create sustainable competitive advantages that advertising budgets alone cannot match.